SEC Nigeria crypto: Regulations, crackdowns, and what it means for users

When you hear SEC Nigeria crypto, the Securities and Exchange Commission of Nigeria’s official stance on digital assets, you’re not just hearing about rules—you’re hearing about money, risk, and survival. Nigeria is one of the most active crypto markets in Africa, with millions trading Bitcoin, Ethereum, and local tokens. But the SEC Nigeria, the federal body responsible for regulating financial markets and protecting investors doesn’t see it as a free-for-all. Since 2021, they’ve been pushing back hard—issuing warnings, freezing assets, and demanding licenses from every exchange, wallet provider, and token issuer operating in the country.

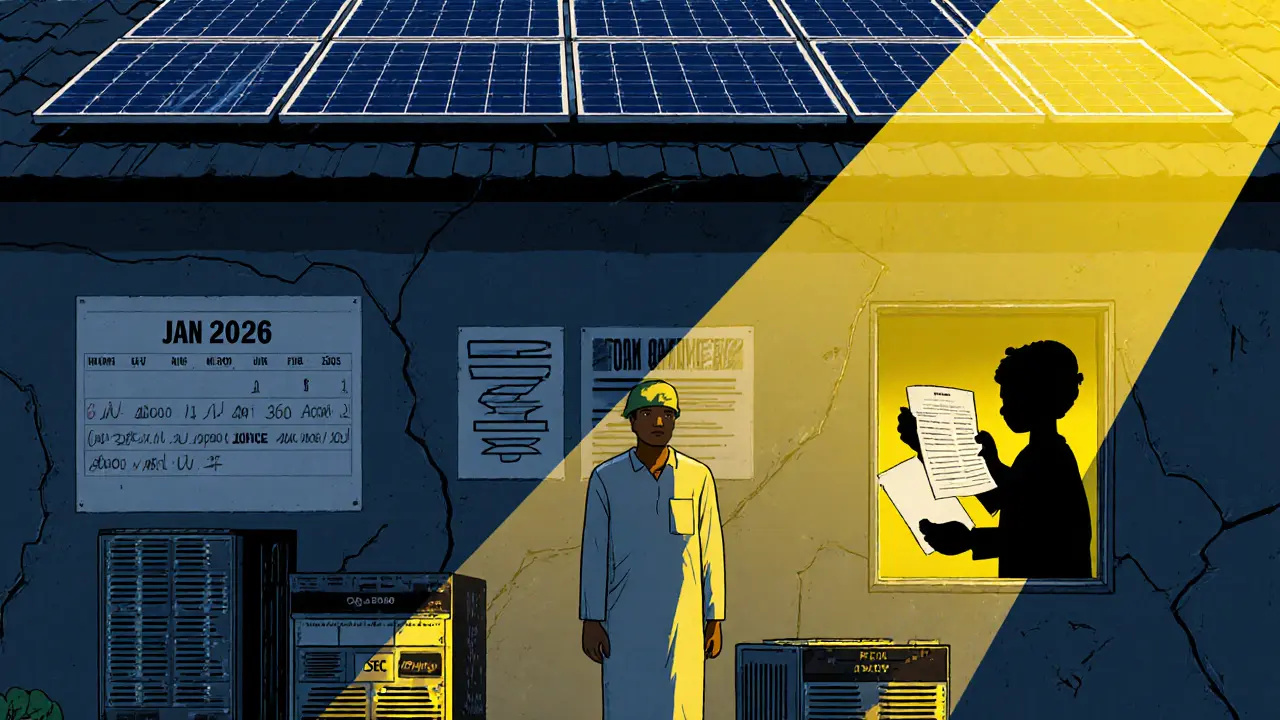

The crypto enforcement Nigeria, the active monitoring and legal action taken by regulators against unlicensed crypto operations isn’t theoretical. In 2023, the SEC blocked access to several popular platforms for failing to register. In 2024, they publicly named over a dozen projects as unregistered securities. And in early 2025, they partnered with banks to freeze accounts tied to crypto transactions flagged as suspicious. This isn’t about stopping innovation—it’s about control. The SEC wants to know who’s trading, how much, and where the money goes. They’re not against crypto; they’re against anonymity, unregulated platforms, and the flood of scams that follow.

What does this mean for you? If you’re using Binance, KuCoin, or any offshore exchange from Nigeria, you’re technically operating in a legal gray zone. The SEC doesn’t ban crypto outright, but it bans unlicensed intermediaries. That means your funds could be frozen overnight if your exchange gets pulled. And if you’re running a token sale, airdrop, or staking pool without SEC approval? You’re at risk of fines, prosecution, or worse. The Nigerian cryptocurrency regulation, the evolving legal framework governing digital asset trading and issuance in Nigeria is still forming, but one thing is clear: compliance isn’t optional anymore. The days of just sending crypto to a wallet and hoping for the best are over.

Below, you’ll find real cases—fines in Vietnam, frozen assets in the Philippines, crackdowns in Korea—that mirror what’s happening in Nigeria. You’ll see how regulators act when they feel out of control, how users get caught in the crossfire, and how to protect yourself before it’s too late. This isn’t theory. It’s happening now. And if you’re in Nigeria, you’re already in the game.