Algeria Crypto Risk & Cost Calculator

Calculate Your Underground Crypto Cost

Based on Algeria's 2025 crypto ban and current underground market rates.

Your Estimated Costs

Based on: 10-25% premium for underground crypto transactions in Algeria after 2025 ban.

Source: Article data on Algeria's crypto ban and underground market rates.

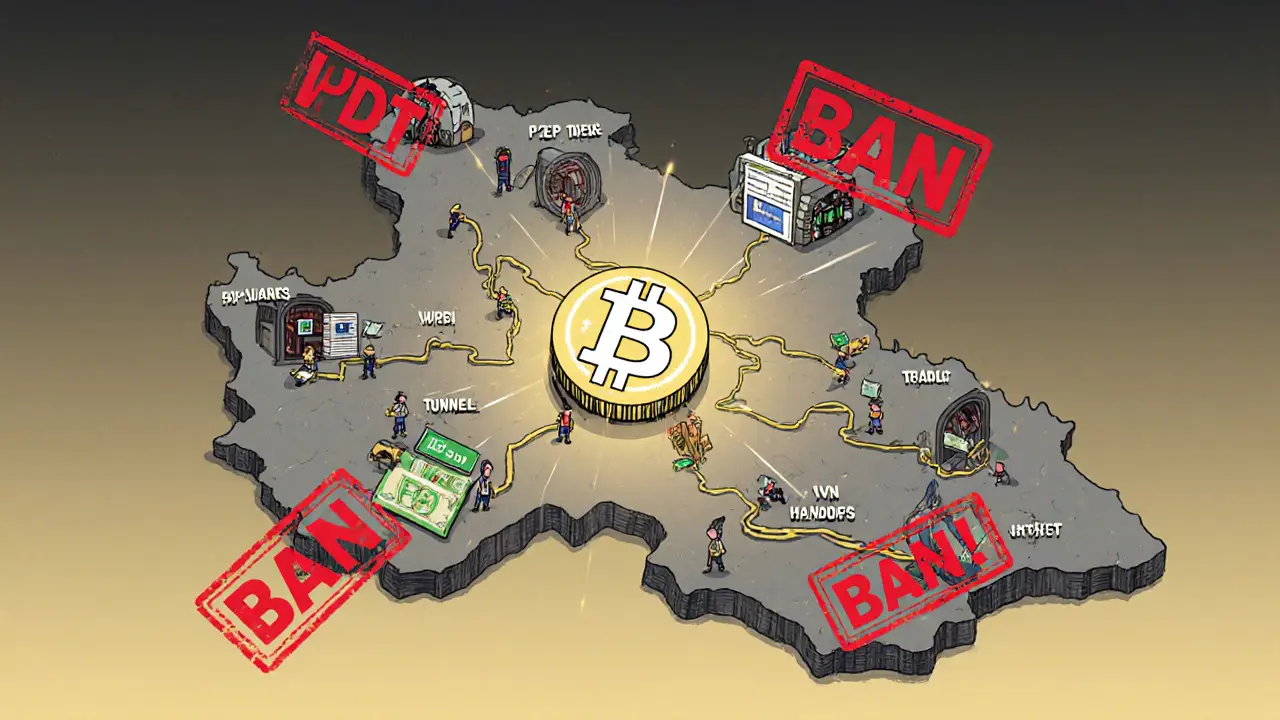

On July 24, 2025, Algeria made it illegal to own, trade, or even hold cryptocurrency. Not just exchange platforms or mining-everything. Holding Bitcoin in a wallet? Illegal. Buying Ethereum from a friend? Criminal. Using USDT to send money abroad? A felony. The law, known as Law No. 25-10, didn’t just restrict crypto-it erased it from legal existence. And yet, it didn’t disappear. It went underground.

What the Law Actually Banned

Algeria’s new law doesn’t just say ‘don’t trade crypto.’ It lists eight specific activities that are now crimes:- Issuing new tokens

- Purchasing or selling digital assets

- Using crypto as payment

- Holding any virtual currency

- Trading for speculation

- Promoting crypto through ads or social media

- Operating exchange platforms

- Mining operations

Why Did Algeria Do This?

The government says it’s about protecting citizens from fraud and stopping money laundering. They point to the Financial Action Task Force (FATF) guidelines as justification. But the real motive? Control. Algeria has one of the most tightly controlled economies in North Africa. The central bank holds tight reins on the dinar. Foreign currency access is restricted. People can’t freely move money out of the country. Crypto threatened that control. Before the ban, Algeria was one of the biggest crypto markets in the MENA region. Chainalysis reported in 2024 that Algerians were among the top users of peer-to-peer crypto in Africa. People used it to send remittances, protect savings from inflation, and buy goods when imports were scarce. The ban didn’t stop demand-it just made it dangerous.How People Are Still Using Crypto

Despite the risk, crypto hasn’t vanished. It’s just hidden.- Peer-to-peer trading: People meet in person-cafés, private homes, even parking lots-to swap cash for Bitcoin or USDT. No apps. No traceable digital trails. Just hand-to-hand.

- International exchanges: Users access Binance, Bybit, or Kraken through VPNs. They deposit via bank transfers to friends abroad or use third-party intermediaries to convert dinars to crypto.

- Stablecoins are king: USDT (Tether) dominates because it’s pegged to the dollar. For Algerians watching their dinar lose value, holding USDT is the only way to preserve savings. Many now use it to buy imported goods from Turkey or China through trusted middlemen.

- Encrypted communication: Signal and Telegram groups replaced public forums. Trading groups now require referrals. No one posts screenshots. No one shares wallet addresses openly.

The Real Cost of Going Underground

The risks aren’t just legal-they’re personal.- Prison time: There have been confirmed arrests. Not just big traders-ordinary people caught with $500 in crypto on their phone.

- Asset seizure: Authorities can freeze bank accounts linked to crypto transactions. Even if you didn’t trade, just having a wallet app installed can trigger an investigation.

- Scams are rampant: With no regulation, fraudsters pose as traders. They take your cash and vanish. Or they set up fake P2P platforms that steal your login details.

- Technical barriers: Using a VPN, securing your device, avoiding metadata leaks-these aren’t skills most people have. The underground market now favors tech-savvy youth and former crypto traders, leaving older users behind.

Who’s Left in the Market?

The underground market isn’t for everyone anymore.- Young professionals: Tech workers, students, freelancers who need to receive payments from abroad.

- Remittance senders: Algerians working in Europe who send money home. Banks are slow. Western Union is expensive. Crypto is faster-even if it’s risky.

- Small importers: Shop owners who buy goods from Turkey or China and pay in USDT to avoid currency controls.

- Former crypto investors: People who bought Bitcoin in 2021 and still hold it. They’re not selling-they’re just holding, hoping the law changes.

Will This Last?

Algeria isn’t the first country to ban crypto. China did it in 2021. Nigeria tried in 2021 and relaxed it in 2023. Egypt banned it but still allows crypto-related startups under strict oversight. In every case, the ban didn’t kill crypto-it pushed it deeper underground. The Algerian government doesn’t have the resources to monitor every phone, every bank transfer, every private meeting. Enforcement is sporadic. Most arrests happen after someone is reported by a rival or a disgruntled ex-trading partner. Meanwhile, technology keeps advancing. Privacy coins like Monero, decentralized exchanges without KYC, and new wallet protocols make it easier to hide transactions. If the ban stays, the underground market will adapt. It will get smarter. More encrypted. More efficient. The real question isn’t whether crypto will survive in Algeria. It’s whether the government can afford to keep fighting a war it can’t win.What Happens Next?

There are three possible paths:- Enforcement intensifies: More arrests, more seizures, more fear. The market shrinks further, but becomes more dangerous and exclusive.

- Enforcement fades: Authorities realize they can’t stop it. They stop chasing small traders and focus only on large-scale operations. The market stabilizes at a low, quiet level.

- The law changes: Economic pressure mounts. Remittance flows drop. Importers struggle. Young people leave for countries where crypto is legal. The government realizes it’s losing talent and capital-and reverses course.

Algeria thought it could erase crypto. It didn’t. It just made it harder, riskier, and more personal. And in doing so, it turned a financial tool into a symbol of resistance.

Is it illegal to own Bitcoin in Algeria?

Yes. Under Law No. 25-10, enacted on July 24, 2025, holding any cryptocurrency-including Bitcoin, Ethereum, or USDT-is a criminal offense. Even if you bought it before the ban, keeping it in a wallet is now illegal. Penalties include fines up to 2 million Algerian dinars ($14,700) and up to one year in prison.

Can you use crypto to send money to family in Algeria?

Technically, no. Sending crypto into Algeria is illegal under the same law that bans holding it. However, some people still do it through underground peer-to-peer networks. A sender abroad might send USDT to a trusted contact in Algeria, who then exchanges it for cash in person. This carries serious legal risk for both parties.

Are there any legal crypto exchanges in Algeria?

No. All domestic crypto exchanges were shut down after the July 2025 ban. International platforms like Binance and Kraken are blocked by the government, but some users access them via VPNs. Using these services still violates Algerian law, and doing so can lead to prosecution.

Why do people still use crypto if it’s illegal?

Because the alternatives are worse. The Algerian dinar is losing value. Banks restrict foreign currency access. Remittances through Western Union cost over 10% in fees. Crypto offers a way to preserve savings, receive payments from abroad, and buy imported goods-despite the risks. For many, the danger is worth the survival.

Has anyone been arrested for using crypto in Algeria?

Yes. While exact numbers aren’t public, multiple confirmed arrests have been reported by local media and human rights groups. Most involve individuals caught with crypto wallets on their phones or cash transactions linked to P2P trades. Penalties have ranged from fines to jail time, especially for repeat offenders.

Can you mine cryptocurrency in Algeria?

No. Mining is explicitly banned under Article 6 bis of Law No. 25-10. Authorities have raided homes and businesses suspected of running mining rigs. The law treats mining the same as trading or holding crypto-any activity that generates or uses digital assets is criminalized.

What’s the most common crypto used in Algeria’s underground market?

USDT (Tether) is the most widely used. Because it’s pegged to the U.S. dollar, it’s the most reliable way to preserve value against the dinar’s inflation. It’s also easier to trade in cash-for-crypto P2P deals since its value is stable. Bitcoin is used too, but less frequently due to its volatility and higher technical barriers.

Is there any chance the ban will be lifted?

It’s possible, but unlikely in the short term. The government sees crypto as a threat to monetary control. However, if economic pressure grows-like falling remittances, brain drain, or import shortages-officials may reconsider. Past bans in other countries have eventually been relaxed. Algeria’s underground market is proof that prohibition doesn’t eliminate demand-it just makes it riskier.

Write a comment