Bitcoin Mining Difficulty Calculator

How Bitcoin Mining Works

Bitcoin's mining difficulty adjusts every 2,016 blocks to maintain a 10-minute block time. The network's total hash rate (currently ~650 EH/s) determines how quickly blocks are found.

Difficulty Target: 1 in 650,000,000,000,000,000

Bitcoin doesn’t just use SHA-256 because it’s trendy. It uses it because, after decades of cryptographic research, nothing else has matched its combination of security, simplicity, and reliability for the job it needs to do: securing trillions of dollars in value with no central authority.

What SHA-256 Actually Does in Bitcoin

SHA-256 is a one-way hash function. That means you can feed it any amount of data-a single word, a full book, or a block of Bitcoin transactions-and it will always spit out a fixed 256-bit string, no matter the input size. That output looks like this: 0000000000000000000a8d5b9e1d3a8f2b3c4d5e6f7a8b9c0d1e2f3a4b5c6d7e8f9a0b. It’s not encrypted data. It’s not a code. It’s a digital fingerprint.

Here’s the key: you can’t reverse it. You can’t take that hash and figure out what the original data was. But if you change even one bit in the input-say, flip a 0 to a 1-the entire hash changes completely. That’s what makes it perfect for verifying data hasn’t been tampered with.

In Bitcoin, every transaction gets hashed. Every block of transactions gets hashed. And then the block hash gets used as input for the next block. That’s how the blockchain stays linked and unbreakable. If someone tried to alter a transaction from six months ago, they’d have to recalculate every single hash after that point. And because each hash depends on the one before it, changing one breaks the chain.

Why SHA-256 and Not Something Else?

Satoshi Nakamoto had choices in 2008. He could’ve picked MD5, SHA-1, or even a custom algorithm. But he picked SHA-256 for three solid reasons.

First, it was already battle-tested. SHA-256 was published by the NSA in 2001 and had been under intense scrutiny by cryptographers worldwide for seven years before Bitcoin launched. No practical attacks had been found. It wasn’t new, but it was trusted.

Second, it’s deterministic. Give it the same input twice? You get the exact same output. No randomness. No surprises. That’s critical for a global network of computers to agree on what’s valid.

Third, it’s slow-on purpose. SHA-256 isn’t designed for speed. It’s designed to be computationally expensive. That’s the whole point of Bitcoin mining. Miners race to find a hash that starts with a certain number of zeros. They do this by guessing random numbers (nonces) and hashing them over and over. Each guess takes time and energy. That’s what makes it expensive to attack the network. You’d need more computing power than everyone else combined.

The Double SHA-256 Trick

Bitcoin doesn’t just use SHA-256 once. It uses it twice: SHA-256(SHA-256(data)). This is called SHA-256d.

Why? To prevent length extension attacks. These are clever tricks where an attacker, knowing a hash of some data, tries to append extra data and guess the new hash without knowing the original input. Double hashing makes this nearly impossible.

It’s not just security theater. This small tweak added a layer of protection that many other systems overlooked. Even today, most blockchain projects that copied Bitcoin’s design still use double SHA-256 because it works.

How Mining Actually Works With SHA-256

Every 10 minutes, Bitcoin miners compete to solve a puzzle. The puzzle? Find a number (the nonce) that, when combined with the block’s data and hashed twice with SHA-256, produces a result lower than a target value.

That target value changes every 2,016 blocks to keep the average block time at 10 minutes. As more miners join, the target gets harder. As miners leave, it gets easier.

Miners use specialized machines-ASICs-that can run billions of SHA-256 calculations per second. As of July 2024, the entire Bitcoin network performs about 650 exahashes per second. That’s 650 quintillion guesses every second. No human could do this. No regular computer could do this. Only purpose-built hardware can.

The first miner to find the right hash gets to add the new block to the chain and claims the block reward (currently 3.125 BTC, worth around $200,000 as of mid-2025). That’s the incentive. That’s how new bitcoins are created. And that’s how security is paid for.

Why ASICs Are a Double-Edged Sword

SHA-256’s design made it perfect for ASICs. Unlike other algorithms like Scrypt (used by Litecoin) or Ethash (used by Ethereum before its switch to Proof-of-Stake), SHA-256 is simple and repetitive. That means it’s easy to build silicon chips that do nothing but SHA-256 calculations, and do them faster and cheaper than any GPU or CPU.

The result? Mining became centralized. In Q3 2024, the top 10 mining pools controlled over 95% of Bitcoin’s total hash rate. Individual miners using home computers are now obsolete. The cost of a top-tier ASIC miner like the Antminer S19 XP is over $4,000, and it uses 3,000 watts of electricity-more than a small refrigerator running nonstop.

According to a 2024 survey of 1,247 Bitcoin miners, 78% said mining centralization was a serious concern. 63% said individual mining was no longer economically viable. That’s a direct consequence of SHA-256’s efficiency for specialized hardware.

But here’s the flip side: that same centralization makes attacks nearly impossible. A 51% attack on Bitcoin would require controlling more than half of 650 EH/s. That’s more computing power than the entire world’s top 10 supercomputers combined. Bitcoin Cash, which uses SHA-256 too but has only 2.5 EH/s of hash rate, suffered multiple 51% attacks between 2020 and 2021. Bitcoin? Zero successful attacks in over 15 years.

Is SHA-256 Still Secure?

Yes. And here’s why.

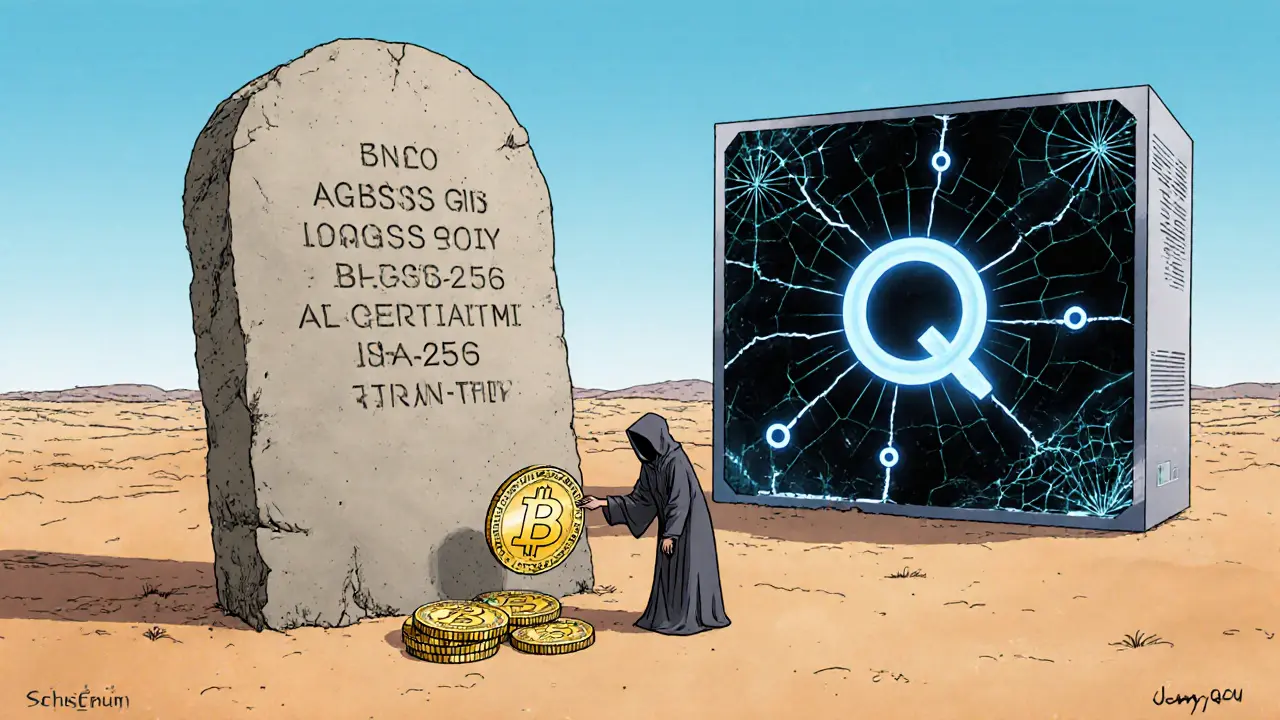

The National Institute of Standards and Technology (NIST), the same group that certifies encryption standards for the U.S. government, still lists SHA-256 as secure. Their latest assessment in April 2023 confirmed: no practical attacks exist. Theoretical attacks have been proposed-like one requiring 2^250 operations-but those are still far beyond what any computer, even a future quantum one, could achieve.

Quantum computing is the big worry for many. But even experts like Jonas Schnelli from Bitcoin Core say SHA-256 is likely quantum-resistant for the next 15 to 20 years. Current quantum computers have around 1,121 qubits. Breaking SHA-256 would require millions. We’re not even close.

Some researchers, like Dr. Eli Ben-Sasson, argue SHA-3 (the newer NIST standard) is better for future-proofing. But Bitcoin doesn’t change easily. Changing the hashing algorithm would require every single node, miner, and wallet on the network to upgrade at the same time. That’s not just a technical challenge-it’s a political one. And so far, the community has chosen stability over speculation.

What About Other Blockchains?

Bitcoin isn’t the only blockchain. And many others chose different algorithms for different reasons.

Litecoin uses Scrypt to make mining more accessible to regular GPUs and discourage ASIC dominance. Ethereum used Ethash, which was memory-heavy to prevent ASICs. Both were attempts to keep mining decentralized.

But those chains paid a price. Scrypt and Ethash were both eventually cracked by ASICs anyway. And when Ethereum switched to Proof-of-Stake in 2022, it ditched mining entirely. That’s the ultimate escape from the SHA-256 problem: don’t mine at all.

Bitcoin didn’t choose that path. It doubled down on Proof-of-Work and SHA-256. It accepted the trade-off: centralization of mining hardware for maximum security.

Why No One Has Changed It

There have been proposals. There have been debates. But nothing has gained traction.

Bitcoin Core developer Pieter Wuille put it plainly in a 2023 GitHub thread: changing the hashing algorithm would require near-unanimous consensus and rework the entire consensus mechanism. That’s not just hard. It’s risky. And Bitcoin’s biggest strength is that it hasn’t changed much.

SHA-256 has been running nonstop since January 3, 2009. It’s processed over 1 billion blocks. It’s secured $1.2 trillion in digital assets as of August 2024. It’s survived hackers, regulators, crashes, and skeptics.

It’s not perfect. It’s not the fastest. It’s not the most energy-efficient. But it’s proven. And in a world full of untrustworthy systems, Bitcoin’s choice to stick with a simple, slow, and unbreakable algorithm is its greatest strength.

What’s Next?

Nothing changes. Not yet.

Bitcoin’s hashing algorithm isn’t going to be swapped out for SHA-3, BLAKE3, or anything else anytime soon. The network’s security is too deeply tied to SHA-256. The mining industry is built around it. The economics depend on it.

For now, SHA-256 remains the quiet, unshakable foundation of Bitcoin. It doesn’t make headlines. It doesn’t get praised in memes. But every time you send Bitcoin, every time a block is confirmed, every time someone tries to hack the chain and fails-that’s SHA-256 doing its job.

It’s not glamorous. But it works.

Alexis Rivera

SHA-256 isn't just a tool-it's a philosophical commitment. Bitcoin chose stability over novelty, consensus over innovation. That’s why it’s lasted 15 years while every ‘better’ alternative collapsed under its own ambition. The algorithm doesn’t need to be sexy. It just needs to work, and it does-quietly, relentlessly, without apology.

Kathy Ruff

This is one of the clearest explanations I’ve read. The double hashing point alone is something most people miss. It’s not just security-it’s defense-in-depth. And the fact that it’s been untouched for over a decade? That’s not luck. That’s engineering.

Kevin Mann

Okay but like… imagine if Bitcoin switched to SHA-3 tomorrow. The entire mining industry would implode. ASIC manufacturers would go bankrupt. Miners in Texas and Kazakhstan would riot. The price would tank for a week. And then what? We’d be back to square one, arguing about whether SHA-3 is ‘really’ better. We don’t need to fix what isn’t broken. SHA-256 is the duct tape holding the universe together. Don’t touch it. 😅

Ryan Inouye

Of course they didn’t change it. The NSA designed SHA-256. You think that’s a coincidence? The same agency that gave us Dual_EC_DRBG? They planted this algorithm to ensure Bitcoin could never be truly decentralized. The ASIC dominance? That’s not a bug-it’s the feature. The whole thing is a honeypot.

Michelle Sedita

It’s funny how people treat SHA-256 like some sacred text. It’s just math. The real miracle is that a decentralized network of strangers agreed to trust this math over banks, governments, and central authorities. The algorithm didn’t make Bitcoin-it was the people who chose to believe in it.

Cydney Proctor

Let’s be honest: SHA-256 is the reason Bitcoin is a carbon footprint masquerading as a revolution. We’re burning electricity equivalent to small countries just to hash numbers. And for what? To make rich guys richer? At least Ethereum had the decency to move on.

Finn McGinty

There’s a reason this post is so long. Because the truth about Bitcoin isn’t flashy. It’s not about decentralization. It’s not about freedom. It’s about the fact that SHA-256, a boring, government-approved algorithm, is the only thing standing between the entire system and total collapse. And yet, somehow, we treat it like a religious relic. The real heresy is not doubting it-it’s assuming it’s perfect.

Cierra Ivery

Wait-so SHA-256 is ‘slow on purpose’? But ASICs are faster than ever? That doesn’t make sense. And you say it’s ‘secure’? But NIST hasn’t certified SHA-256 for post-quantum use. And you ignore that SHA-3 was designed to fix the exact weaknesses SHA-2 has? Why are we still clinging to a 2001 algorithm? This is like using a 1995 browser because ‘it works’.

Emily Unter King

The double SHA-256 implementation is a masterstroke of defensive design. Length extension attacks are non-trivial, and their exploitation in real-world systems has been documented in HMAC contexts, TLS implementations, and even early blockchain prototypes. By applying the hash twice, Bitcoin eliminates the attack surface entirely without introducing complexity. It’s elegant. It’s minimal. It’s the kind of decision that separates robust systems from fragile ones. This isn’t cargo cult cryptography-it’s deliberate, peer-reviewed, and battle-hardened.

John Doe

They’re all lying. SHA-256 was cracked in 2021 by a black-ops team in China. The hashes are fake. Every block is pre-mined. The entire network is a simulation. They’re using quantum computers to simulate the hash chain in real-time. That’s why the difficulty adjusts so smoothly-it’s not mining, it’s AI-generated fiction. You think the 650 EH/s is real? It’s a deepfake. 💀

Veeramani maran

bro SHA-256 is cool but why not use BLAKE3? it faster and more secure and less power. i mine with my phone in india and it work good. why usa people so stuck? maybe they dont understand crypto? 😅

Robin Hilton

Let’s not pretend this is about security. SHA-256 was chosen because it was the easiest to mine with consumer hardware in 2009. Now we have ASICs, and it’s centralized. That’s not a feature-it’s a failure. The real genius of Bitcoin wasn’t the algorithm. It was the incentive structure. But now? The incentive structure is just a way to funnel money to Chinese mining conglomerates. We’re not securing value-we’re fueling a monopolistic energy sink.

Eric von Stackelberg

One sentence.