Crypto Regulations and Exchanges in November 2025: Real Reviews and Scam Alerts

When you're trying to navigate crypto regulations, the legal rules governments set for buying, trading, and holding digital assets. Also known as cryptocurrency laws, it's no longer enough to just pick a wallet—you need to know who’s watching, who’s enforcing, and where you’re at risk. In November 2025, the world didn’t just tweak rules—it rewrote them. Indonesia moved crypto from commodity status to financial oversight under the OJK. Japan tightened its licensing system with new FIEA rules. South Korea hit Upbit with a $34 billion fine for KYC failures, sending shockwaves through every exchange that skipped user verification. And Canada seized $40 million from TradeOgre, proving even anonymous platforms aren’t safe anymore.

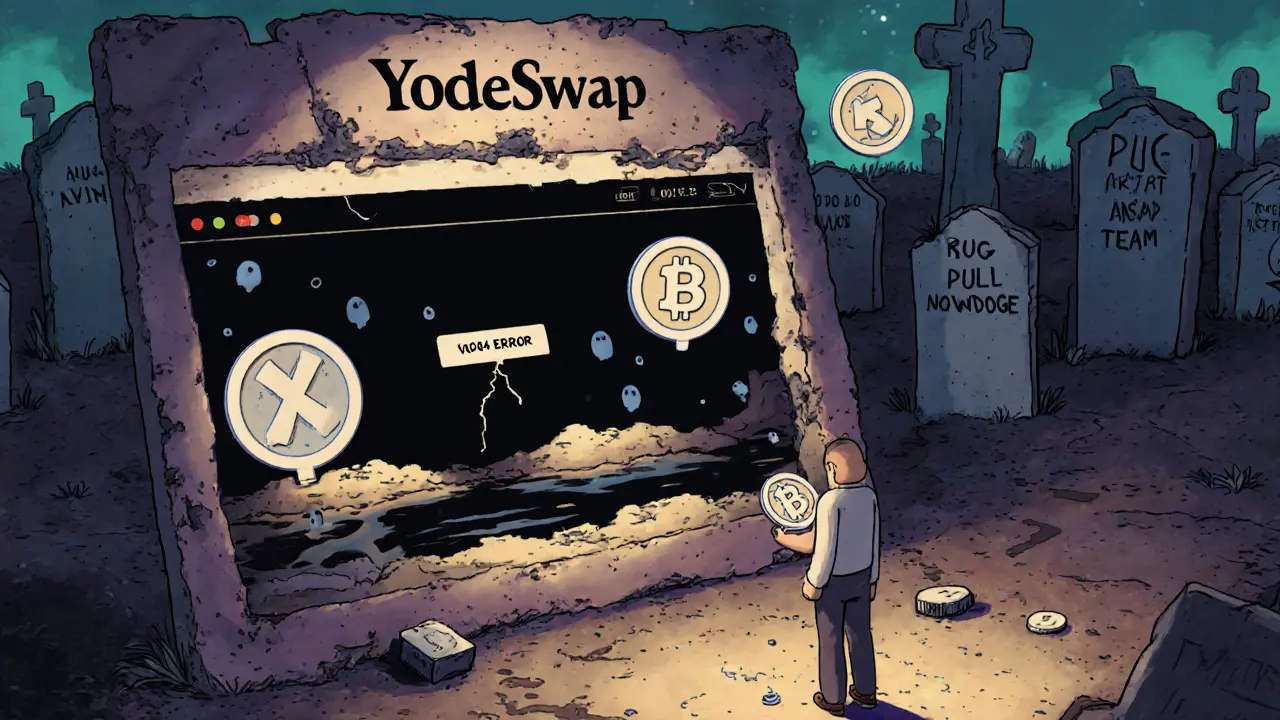

crypto exchange, a platform where people buy, sell, or trade cryptocurrencies. Also known as cryptocurrency trading platform, it's the gateway to the market—but not all gateways are real. This month, we saw the collapse of Bvnex, the shutdown of YodeSwap, and the exposure of LongBit as a complete fake. Meanwhile, legitimate players like AscendEX and ARzPaya kept operating, but only for users outside strict jurisdictions. The lesson? A platform with low fees and fast trades means nothing if it’s unregulated, unaudited, or vanished overnight. And if a site claims to be AnimeSwap on Sui or Elk Finance as an exchange? It’s a lie. These aren’t glitches—they’re red flags. Then there’s the crypto scams, fraudulent schemes that trick people into sending crypto or giving up private keys. Also known as crypto fraud, they don’t need fancy tech—just a good story. Fake airdrops for HyperGraph (HGT), CovidToken, and HappyFans (HAPPY) flooded forums. TripCandy’s CANDY token? Real—but only earned by booking travel, not by clicking links. WNT from Wicrypt? Never an airdrop; you earn it by sharing WiFi. The same pattern repeats: if it sounds too easy, it’s designed to steal. And beneath the surface, DeFi risks, hidden dangers in decentralized finance protocols like liquidity pools and cross-chain swaps. Also known as blockchain financial risks, they’re silent killers. Impermanent loss isn’t a rumor—it’s a math problem that wipes out gains even when prices go up. Elk Finance on OKX Chain? A tool, not a magic wallet. Moola Market on Celo? Built for mobile users, but struggling with adoption. These aren’t failures of tech—they’re failures of expectation.

What you’ll find below isn’t just a list of articles. It’s a map of what actually happened in November 2025: the exchanges that survived, the ones that vanished, the airdrops that never existed, and the regulations that changed everything. No fluff. No hype. Just what you need to know before you trade, invest, or click 'Confirm' again.