P2P Crypto Fee Calculator

Estimate Your Trade Costs

Based on 2021 China crypto ban: Transaction fees now 3-5% for P2P trades. Bank freezes occur in 40% of transactions.

Trade Summary

Trade Amount

Estimated Fee

Final Amount Received

Critical Risk Warning

Based on article data:

- 40% of transactions experience bank freezes

- Scams result in average $25,000 losses

- 895 people convicted in 2022 (over $150M fines)

Never use main bank accounts. Split payments under 50,000 RMB. Verify transfers through multiple channels.

China banned cryptocurrency exchanges in September 2021. Banks were told to cut off services. Mining rigs were shut down. The government said it was about financial stability. But if you look at the data, crypto didn’t disappear-it just went deeper underground. Today, peer-to-peer crypto trading in China is still alive, risky, and surprisingly active. Not because people are ignoring the law, but because the need to move money out of China hasn’t gone away.

Why the ban didn’t stop crypto

The Chinese government didn’t ban owning crypto. It banned trading on exchanges and financial institutions from handling crypto transactions. That’s a crucial difference. Courts in Shenzhen, Hangzhou, and Shanghai had already ruled in 2018 that cryptocurrencies are legal property under Chinese civil law. So if you hold Bitcoin or USDT in your wallet? That’s fine. But if you use a platform like Binance or Huobi to buy or sell? That’s illegal. That gap created the perfect opening for P2P trading. Instead of going through a centralized exchange, people now trade directly with each other. One person sends RMB through Alipay or WeChat Pay. The other sends crypto to their wallet. No middleman. No paper trail. Just two people, a phone, and a VPN.How it actually works

It’s not as simple as opening an app and clicking “buy.” This is a high-stakes, high-skill operation. Here’s how real users do it:- They use a VPN to access international P2P platforms like LocalBitcoins, Paxful, or Bisq. Without it, the Great Firewall blocks them.

- They set up a non-Chinese email and wallet-preferably one without Chinese language support-to avoid detection.

- They communicate through encrypted apps like Telegram or private WeChat groups. These groups use code names like “Green Tea” or “Mountain River” to avoid keyword filters.

- They trade mostly in USDT (Tether). Why? Because it’s stable. You’re not gambling on Bitcoin’s price swings-you’re moving value. One USDT = $1. Simple.

- They split payments. If you need to send 200,000 RMB, you don’t do it all at once. You break it into five 40,000 RMB transfers. Banks trigger alerts at 50,000 RMB. Stay under that, and you fly under the radar.

One user on Reddit, who goes by ShanghaiTrader88, said he’s done 147 trades since the ban, totaling over $170,000. His rule? Never use your main bank account. Always use a temporary one opened just for crypto. And never, ever trust a screenshot of a bank transfer. Scammers send fake ones all the time.

The hidden cost: risk and fees

This isn’t free money. The price of doing business in China’s crypto underground is steep.- Transaction fees jumped from less than 1% before the ban to 3-5% today. That’s because sellers charge more to cover the risk of getting frozen out by banks or reported to authorities.

- Scams are common. In 2022, a user on Trustpilot lost $25,000 after a counterparty sent fake bank proof. The scammer then claimed the transfer was fraudulent, got the victim’s account frozen, and vanished.

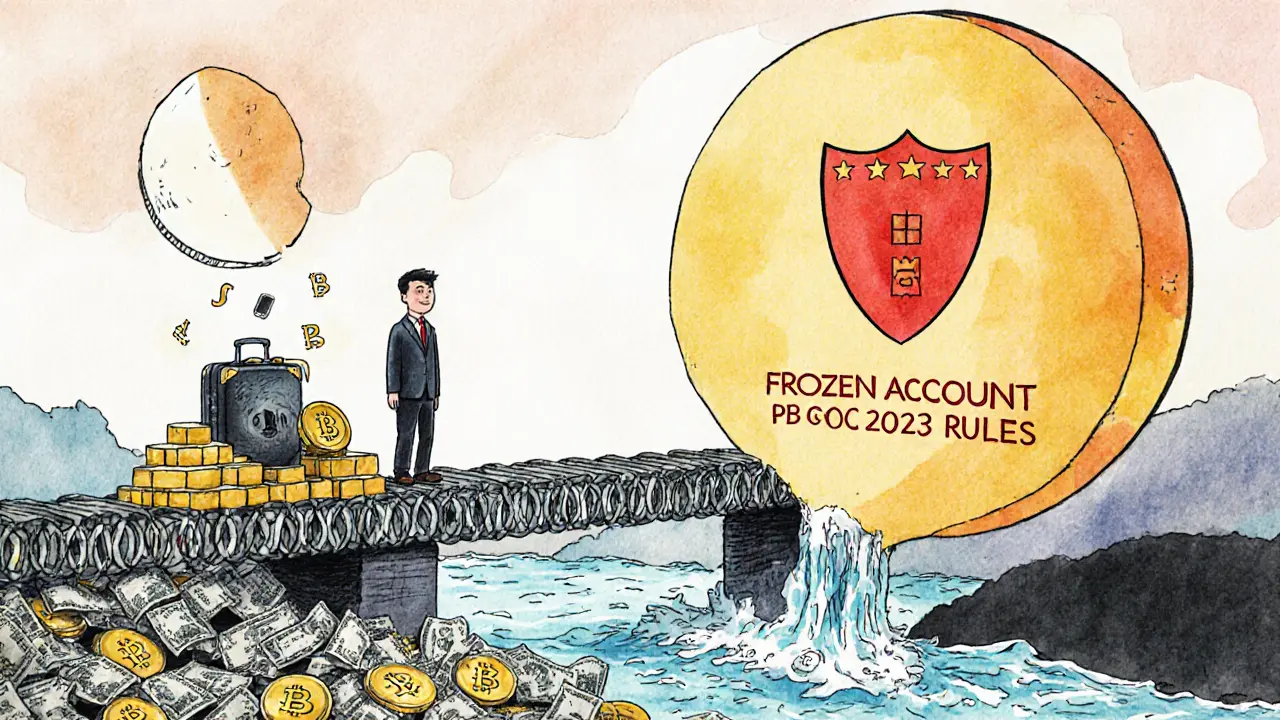

- Bank freezes happen in nearly 40% of transactions. You send your RMB. They send the crypto. Then your bank calls you: “Why did you send money to a stranger?” Your account gets locked for weeks. No explanation. No appeal.

- Legal risk is real. In 2022, China’s State Administration of Foreign Exchange investigated 1,247 crypto cases. 895 people were convicted. Fines totaled over $150 million.

It’s not just about money. It’s about time. One GitHub guide, written by a user called CryptoSurvivorCN, says new traders need 3-4 weeks just to learn how to avoid getting caught. That’s 100+ hours of research, testing, and failed attempts.

Who’s still trading?

It’s not college kids or hobbyists. The users are professionals.A 2022 study from Peking University tracked 1,200 crypto users in China. Most were between 25 and 45. They had university degrees. Many worked in international business, tech, or finance. Some had family overseas. Others wanted to protect savings from currency devaluation. A few were trying to pay for foreign education or medical care.

They’re not trying to get rich off Bitcoin. They’re trying to move money safely. And crypto is the only tool left that works.

What’s changing now?

The government didn’t stop at the 2021 ban. In January 2023, the People’s Bank of China issued new rules targeting “any form of decentralized transaction.” That means even direct wallet-to-wallet trades are now on the radar.Traders are adapting. Some are using NFTs as value carriers-buying a digital art piece with crypto, then selling it back for RMB. Others are doing “crypto barter”: trading Bitcoin for imported electronics, luxury goods, or even gold bars. No cash changes hands. No bank transfer. Just goods moving across borders.

Chainalysis reported a 300% increase in P2P volume from Chinese IP addresses in early 2022. That’s not a glitch. That’s demand. Despite the crackdown, China still accounts for 4-5% of global crypto transaction volume. That’s more than Japan, Germany, or Canada.

Why can’t China shut it down completely?

Because P2P crypto isn’t a company. It’s not a server in a data center. It’s millions of phones, wallets, and bank accounts. You can shut down Binance. You can’t shut down a person who sends $5,000 to their cousin in Canada using WeChat Pay.Dr. Camilla Russo, a blockchain expert, called China’s ban “the world’s largest natural experiment in cryptocurrency resilience.” The result? Decentralized networks don’t die. They evolve.

HSBC’s research team put it bluntly: “The cat is out of the bag.” China can’t stop P2P trading without turning its entire economy into a surveillance state. That would hurt real business-foreign investment, exports, travel, education. So they keep enforcing, but they don’t expect to win.

What’s next?

Binance Research predicts China’s P2P volume will stay between 3-5% of global activity through 2025. That’s not growth. But it’s not collapse either.The government will keep improving its surveillance tools. Banks will get smarter at flagging suspicious transfers. Scammers will keep finding new ways to trick people.

But as long as there’s pressure to move money out of China-whether for safety, opportunity, or survival-P2P crypto will keep running. It’s not legal. It’s not safe. But for now, it’s the only option left.

Can you do it safely?

If you’re thinking about trying it, here’s the truth: no, you can’t do it safely. There’s no such thing as a risk-free P2P trade in China. Even the most experienced traders get caught. Accounts get frozen. Money disappears. You can be fined. You can be investigated.The only people who “succeed” are those who treat it like a black-market operation-not an investment. They use burner phones. They never reuse wallets. They avoid big transfers. They never talk about it online. They know the rules: small amounts, fast moves, no trust, no emotion.

And even then, luck runs out.

Debraj Dutta

It's fascinating to observe how market forces adapt to regulatory constraints. The persistence of P2P crypto in China underscores a fundamental truth: when individuals have a legitimate need to transact, they will find a way, regardless of legal barriers. The shift from centralized exchanges to decentralized, informal networks is not a flaw in the system-it’s a feature of human ingenuity.

tom west

Let’s be brutally honest-this isn’t ‘resilience,’ it’s financial recklessness dressed up as innovation. People are risking prison, asset forfeiture, and bank freezes because they refuse to accept that their government has legitimate concerns about capital flight and money laundering. This isn’t freedom-it’s a self-inflicted disaster masked as rebellion. The fact that 895 people were convicted in 2022 alone should be a wake-up call, not a badge of honor.

dhirendra pratap singh

OMG I CANNOT BELIEVE THIS IS STILL HAPPENING 😭💸 People are literally gambling with their FREEDOM for crypto?! I just watched a video of a guy in Guangzhou getting dragged away by cops after a 200K RMB transfer-his wife was crying on live stream!!! This is NOT worth it!!! 🤕 #CryptoIsACult

Edward Phuakwatana

What’s wild is how this mirrors the early days of the internet-when governments tried to regulate what couldn’t be contained. Crypto in China isn’t just surviving; it’s evolving into a decentralized, adaptive ecosystem. The use of NFTs as value carriers? Genius. Crypto barter? Pure organic innovation. The state can monitor IPs and flag transfers, but they can’t stop people from trading a digital painting for a Rolex or a bag of gold dust across the border. This is the future of finance: permissionless, peer-to-peer, and painfully human. 🌐💎

Suhail Kashmiri

Why do people even bother? If you’re gonna break the law, at least have the guts to do it for something real-like protest or art. Not to squirrel away cash so you can buy a Tesla in Dubai. This is just rich people cheating the system while the rest of us pay taxes. Pathetic.

Kristin LeGard

China’s doing what any sovereign nation should do-protecting its economy from speculative chaos. These traders are playing with fire, and now they’re surprised when they get burned? Newsflash: the U.S. doesn’t let people trade dollars for Bitcoin on the black market either. Stop romanticizing lawbreaking. It’s not rebellion-it’s stupidity.

Arthur Coddington

I mean… if you think about it, isn’t this just capitalism’s final form? People trading value directly, outside the system, because the system failed them? We’re all just nodes in a network now. The state can’t win. The blockchain doesn’t care about borders. It’s poetic, really. Or maybe I’m just high. 🤷♂️

Phil Bradley

Hey, I just wanna say-I get it. I’ve got cousins in Shanghai who’ve been doing this for years. It’s not about getting rich. It’s about keeping their kids in school overseas, or paying for a parent’s cancer treatment in Germany. No one’s talking about that. These aren’t speculators-they’re people trying to survive in a system that doesn’t let them move their own money. Just… be kind. 🤝

Stephanie Platis

Actually, the legal framework in China is far more nuanced than most Western observers realize: while exchanges are banned, private, non-commercial transfers of crypto as property are not inherently criminal-unless they involve foreign exchange violations, money laundering, or circumvention of capital controls. The distinction matters. Furthermore, the 3–5% fee is not merely ‘risk premium’-it’s a de facto tax on financial exclusion.

Michelle Elizabeth

It’s ironic, really. The same people who scream about ‘decentralization’ and ‘freedom’ are now relying on a system that requires VPNs, burner phones, and coded language just to exist. How decentralized is that? It’s just capitalism with a side of paranoia. And honestly? The whole thing feels… sad.

Joy Whitenburg

ugh i just read this and my heart hurts 😔 i know someone who did this and her account got frozen for 6 months-she had to sell her laptop to pay rent. it’s not some cool underground movement-it’s people scrambling. pls be careful out there. you don’t need to be a hero. just… breathe. 🫂

Kylie Stavinoha

This phenomenon reflects a deeper truth about modern economies: trust in institutions is eroding. When citizens no longer believe their government will protect their financial future, they turn to alternatives-even risky, illegal ones. The persistence of P2P crypto in China isn’t a failure of regulation; it’s a failure of inclusion. The state must ask not ‘how do we stop this?’ but ‘why did this become necessary?’